Fair Lending Options & Quality of Life

To improve the quality of life for employees a new social contract is needed. Part of this new “contract” is working with employers to provide low-interest lending options. In times of economic uncertainty and short-term resource gaps, households often turn to high-interest lending options; these exploitative, predatory schemes disproportionately impact Black, Indigenous, and People of Color households. We are committed to working together with public and private partners to develop and scale equitable lending options for New Mexico households statewide.

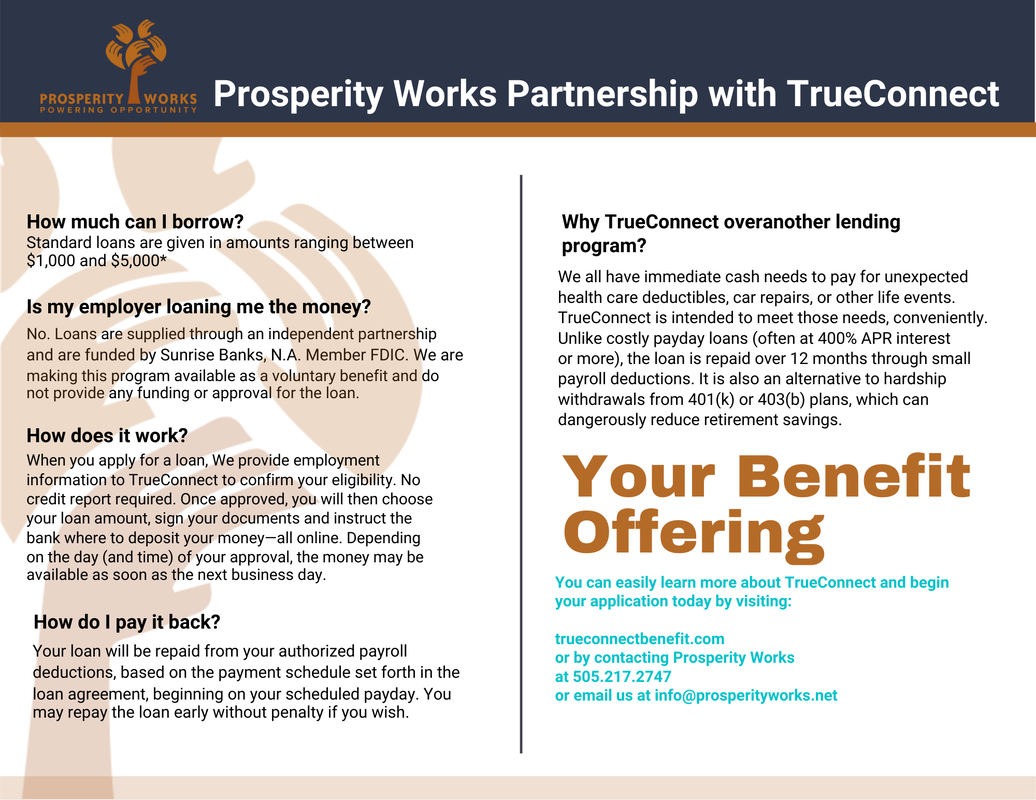

Prosperity Works' Partnership with TrueConnect

Prosperity Works recognized the extent to which high-interest predatory lenders undermined individual borrowers’ long-term financial health and eroded community economic development initiatives. This was the impetus for us to advocate for legislation to protect consumers.

Through our partnership with TrueConnect, employees in New Mexico have an equitable lending alternative to predatory storefront lenders. TrueConnect is an employer-provided loan product that assists employees in accessing a fair loan.

Employers across the state, and across all sectors, have adopted TrueConnect. With no cost or risk to the employer and no credit check for the employee, these loans of up to $5,000 help employees address short-term emergencies and reduce financial stress—all of which support a healthier, more productive workplace.

"TrueConnect exists to provide safe, affordable financial support and hope to employees in need of a helping hand that is an alternative to predatory lending products. We strive for the economic health of those we serve and offer relief to your employees when unexpected emergencies arise. We are a technology-driven solution enabling you to offer your employees the right solution to get them through their tough financial time with the convenience of paycheck deductions. It costs nothing to employers to offer and is simple to manage."

Through our partnership with TrueConnect, employees in New Mexico have an equitable lending alternative to predatory storefront lenders. TrueConnect is an employer-provided loan product that assists employees in accessing a fair loan.

Employers across the state, and across all sectors, have adopted TrueConnect. With no cost or risk to the employer and no credit check for the employee, these loans of up to $5,000 help employees address short-term emergencies and reduce financial stress—all of which support a healthier, more productive workplace.

"TrueConnect exists to provide safe, affordable financial support and hope to employees in need of a helping hand that is an alternative to predatory lending products. We strive for the economic health of those we serve and offer relief to your employees when unexpected emergencies arise. We are a technology-driven solution enabling you to offer your employees the right solution to get them through their tough financial time with the convenience of paycheck deductions. It costs nothing to employers to offer and is simple to manage."